When examining the economic landscape of generative AI (genAI), there are many different aspects to consider. However, in this article, we’ll focus primarily on the economics surrounding two areas: (1) the companies building and selling access to these foundation models, e.g., Anthropic, Cohere, Google, Meta, Microsoft, and OpenAI, and (2) the companies paying for access to these models in order to cut costs, streamline workflows, and otherwise drive value.

The shaky economics of OpenAI

First, let’s quickly look at the economic struggles of OpenAI, arguably the leading entity building general-purpose foundation models today. Sam Altman’s company, which is currently losing money on its $20/month subscription model, lost $5b on $3.7b in revenue in 2024.

OpenAI projects revenue of $11.6b in 2025 and $100b in 2029. At first glance, the $100b figure seems a bit outlandish; however, the company’s PowerPoint decks would certainly need to show projected revenue of this nature to continue to drive funding. To his credit, Altman has effectively used the pursuit of artificial general intelligence (AGI) to drive investment.

Thus far, over 10 funding rounds, OpenAI has raised $17.9b. The two largest rounds were a $6.6b Series E in October 2024 and the widely-reported $10b Microsoft round in January 2023. At 13.5x projected forward revenue, OpenAI’s valuation is currently at $157b.

By framing AGI as too important not to pursue, Altman has gotten away with spending a staggering amount of money. Speaking to a group of Stanford students last May, Altman said,

“Whether we burn $500 million a year or $5 billion—or $50 billion a year—I don’t care, I genuinely don’t. As long as we can figure out a way to pay the bills, we’re making AGI. It’s going to be expensive.”

And expensive it has been.The company currently pays over $700k/day to run ChatGPT, and computing costs alone were estimated to be $6b in 2024. To be fair to OpenAI, the company’s growth is outpacing the early days of successful tech companies like Facebook, which was similarly valued at 13.5x forward revenue when it IPO’d. However, an important difference is that Facebook (now Meta) was able to lower costs as it grew. This will not be the case with OpenAI.

As Foundation Capital partner Ashu Garg explains,

“OpenAI plans to 100x revenue to $100B by 2029 while piling up progressively larger losses. This requires maintaining 93% annual growth for five years—a rate achieved by only a handful of companies in history, all of which saw their economics improve with scale…Building and improving foundation models requires massive ongoing investment, yet their value erodes faster than perhaps any other technology to date.”

Garg does not see a viable economic pathway for OpenAI and other entities focusing on building general-purpose LLMs; however, as an aside, he is optimistic about the potential for genAI start-ups building specialized products that target specific needs within specific industries.

OpenAI currently is relying on its $20/month subscription model, in addition to its model-as-a-service (MaaS) activities, which include licensing agreements, API services, and various enterprise solutions. OpenAI should, and will, eventually switch to a usage-based pricing model; however, that alone is not going to get them into the green any time soon.

What I foresee is an advertising model—an eventual full-on pivot to user data collection and monetization. More on this later. First, let’s look at the second macro-level genAI sector: the companies paying to access genAI models in order to cut costs and drive value.

The economic impact on the companies utilizing genAI systems

According to a recent McKinsey report, genAI will have a positive economic impact on many work activities. After looking at 63 different genAI use cases across work activities throughout 850 occupations, the firm estimates that genAI is poised to bring in trillions of dollars ($2.6t – $4.4t) worth of economic benefits due to cost reductions, job displacement, and improved productivity.

Much of the benefit garnered from genAI is found to be in sales and marketing, software engineering, R&D, and customer operations. In fact, the study’s authors estimated that these four business functions will account for 75 percent of all the projected value from genAI.

While reading the McKinsey report, it immediately became clear to me how much of this newfound economic value would be unearthed: by using genAI systems to more effectively target consumers based on their interests and behaviors. In regard to genAI’s impact on sales and marketing work activities, the McKinsey authors write, “The technology can create personalized messages tailored to individual customer interests, preferences, and behaviors.” Likewise, when assessing product discovery and search personalization, the authors explain,

“With generative AI, product discovery and search can be personalized with multimodal inputs from text, images, and speech, and a deep understanding of customer profiles. For example, technology can leverage individual user preferences, behavior, and purchase history to help customers discover the most relevant products and generate personalized product descriptions.”

Elsewhere in the report, the authors note that genAI could increase sales. They write,

“Generative AI could identify and prioritize sales leads by creating comprehensive consumer profiles from structured and unstructured data and suggesting actions to staff to improve client engagement at every point of contact.”

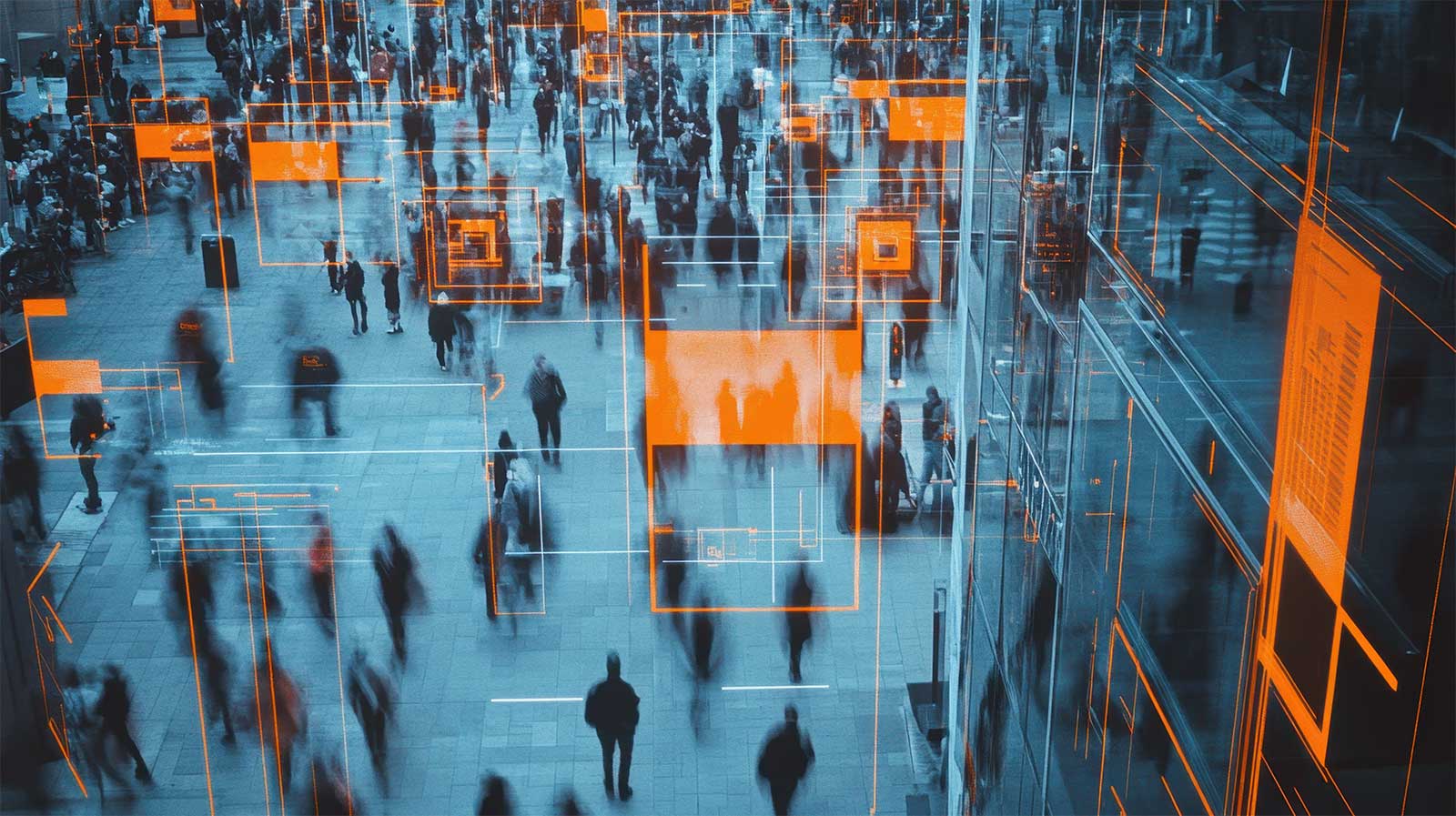

So, a large part of the $2.6 trillion – $4.4 trillion in economic benefits that McKinsey predicts genAI systems will bring is the result of companies being able to more effectively target consumers. Makes sense. Put differently, genAI’s future profitability, at least in part, will require the models to ingest a lot of personal consumer data. And the economic promise of genAI is based on its ability to supercharge the data surveillance ecosystem—one in which companies like Meta and Google already thrive.

Quick caveats

In this article, I suggest that Altman is using “the importance of AGI” as a marketing and fundraising device, which is true. However, I would be remiss if I didn’t point out that there is some truth to his notion that the pursuit of advanced genAI systems is a noble one—albeit one that poses significant opportunities and risks alike. Let’s take the biotech industry as an example; deployed accurately, genAI systems could improve drug discovery and change lives. Deployed inaccurately, lives could be put at risk. And again, in that space, there are a lot of privacy concerns.

This article completely ignores other risks and important issues: (1) Will the models be accurate, unbiased, and explainable? (2) Do they infringe on copyrighted works? For his part, Altman has already admitted that he can’t build his models without infringing on copyrighted works. (3) There’s also the issue of potential “model collapse,” whereby models’ outputs deteriorate and become biased or poor in quality; this could arise due to a lack of available training data, copyright lawsuits, or challenges related to using synthetic data to train models.

Key takeaways

Given the nature of the incoming presidential administration, we will likely see less tech regulation and more M&A; the big data surveillance players, like Google and Meta, will be able to acquire genAI competitors and start-ups—either for these competitors’ IP or just to remove the competition.

Overall, what we’ll see is that genAI systems will provide fuel to the consumer data collection and monetization landscape. These systems will help companies in the surveillance business more accurately target their customers.

Also, consumer data collection will provide a financial lifeline to the companies that are actually building the genAI systems. Soon, if they aren’t already, OpenAI and others will use the information being put into their prompts to build profiles on users, further train their models, and eventually target their users with advertisements. We’ve already seen Perplexity come out and acknowledge that it’s time to experiment with ads. OpenAI and others will follow suit.